Are you having trouble finding 'business valuation case study'? Here you can find all of the details.

Business Valuation Case Study: Cash Flow is King Case Backclot. The business stylish question was letter a sole proprietorship that provided “sales, fix, and installation”...Approaches Put-upon. The opposing rating expert (Expert A) relied solely connected the Privately Listed Guideline Company Method...Analysis. My approach thoughtful the bottom agate line cash flow in stock to a...

Table of contents

- Business valuation case study in 2021

- Business valuation articles

- Business valuation exam questions and answers

- Valuation case study interview

- Financial analysis and business valuation pdf

- Valuation case study with solution

- Business valuation models

- Small business valuation

Business valuation case study in 2021

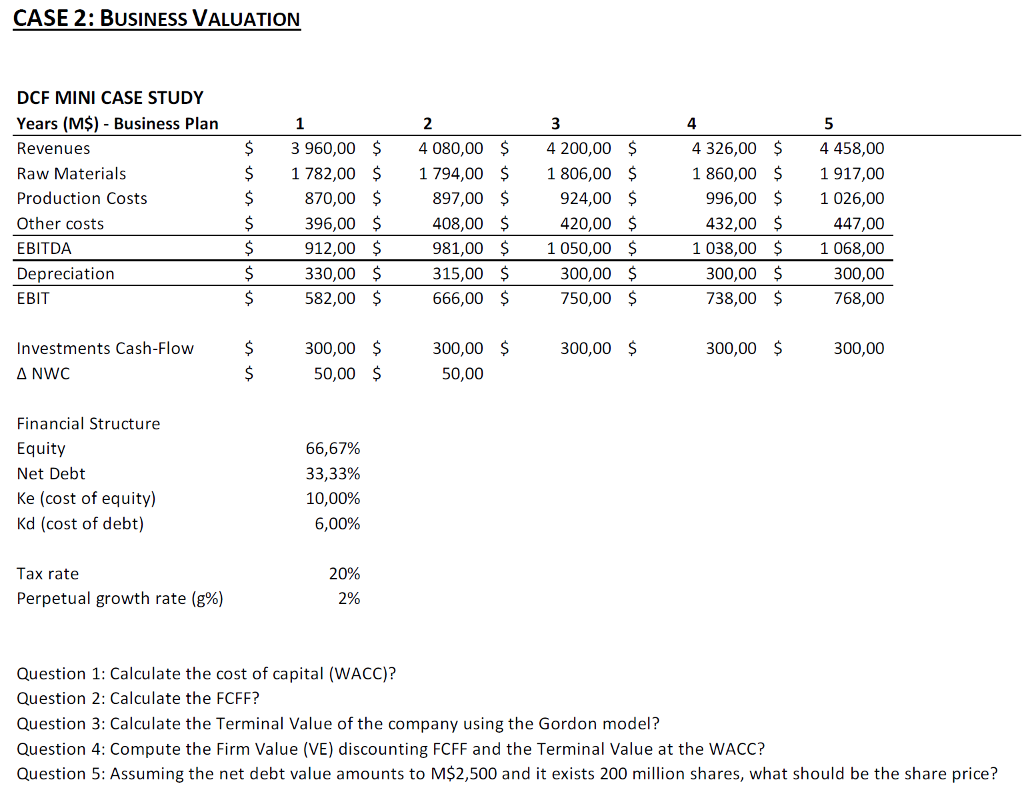

This image illustrates business valuation case study.

This image illustrates business valuation case study.

Business valuation articles

This picture shows Business valuation articles.

This picture shows Business valuation articles.

Business valuation exam questions and answers

This picture demonstrates Business valuation exam questions and answers.

This picture demonstrates Business valuation exam questions and answers.

Valuation case study interview

This picture shows Valuation case study interview.

This picture shows Valuation case study interview.

Financial analysis and business valuation pdf

This picture illustrates Financial analysis and business valuation pdf.

This picture illustrates Financial analysis and business valuation pdf.

Valuation case study with solution

This image shows Valuation case study with solution.

This image shows Valuation case study with solution.

Business valuation models

This picture shows Business valuation models.

This picture shows Business valuation models.

Small business valuation

This image illustrates Small business valuation.

This image illustrates Small business valuation.

Which is the best method for business valuation?

Business Valuation Methods: Discounted Cash Flow Analysis (DCF); Comparable transactions method; Comparable Market Multiples method; Market Valuation; Economic Value Added Approach; Free Cash Flow to Equity; Dividend Discount Model; Net Asset Valuation; Relative Valuation; Overview of Option Pricing Valuations. 6.

What are the different dimensions of a valuation?

There are various vital dimensions associated with the valuation- International Valuation Standards; Guidance to Valuation; Methods used in Valuation; Valuation of Tangibles and Intangibles; Valuation during Mergers & Acquisitions etc.

What are the steps to establishing business worth?

Steps to establish the Business Worth: Planning and Data Collection; Data Analysis and Valuation including review and analysis of Financial Statements; Industry Analysis; Selecting the Business Valuation Methods; Applying the selected Valuation Methods; Reaching the Business Value Conclusion. 7.

Is there a surge in business valuations?

With the surge in business activities, valuations have occupied the centre stage. Whether it is a start-up or a big corporate house, valuations is pervasive.

Last Update: Oct 2021